The stock market is a dynamic entity, constantly influenced by a myriad of factors, particularly global events. Understanding how global events are shaping the stock market is crucial for investors and analysts alike. From geopolitical tensions to economic shifts and environmental crises, these events can trigger significant fluctuations in market performance. In this article, we will delve into the intricate relationship between global happenings and stock market trends, providing insights that can help you navigate the complexities of investing in today’s interconnected world.

As we explore this topic, you will learn about the various types of global events that impact stock prices, including political instability, natural disasters, and international trade agreements. We will also discuss how these events can create both opportunities and risks for investors, highlighting the importance of staying informed and adaptable. Furthermore, we will examine historical examples that illustrate the profound effects of global occurrences on market behavior, offering valuable lessons for future investment strategies.

By the end of this article, you will have a deeper understanding of the forces at play in the stock market and how to leverage this knowledge to make informed investment decisions. Whether you are a seasoned investor or just starting out, the insights provided here will equip you with the tools needed to thrive in a rapidly changing financial landscape. So, read on to discover how global events are shaping the stock market and what it means for your investment journey.

Economic Indicators and Stock Market Trends

Economic indicators such as GDP growth, unemployment rates, and inflation play a crucial role in shaping investor sentiment and stock market trends. When economic indicators show positive growth, investors are more likely to invest in stocks, driving prices up. Conversely, negative indicators can lead to market downturns as investors seek safer assets.

For instance, a rise in unemployment rates may signal economic distress, prompting investors to sell off stocks. Understanding these indicators helps investors make informed decisions and anticipate market movements, making it essential to monitor them closely.

Geopolitical Tensions and Market Volatility

Geopolitical events, such as conflicts, trade wars, and diplomatic relations, can significantly impact stock market stability. Tensions between countries can lead to uncertainty, causing investors to react swiftly, often resulting in increased volatility. For example, trade disputes can affect supply chains and corporate earnings, leading to stock price fluctuations.

Investors often look for safe-haven assets during geopolitical crises, which can lead to a decline in stock prices. Understanding the implications of these events is vital for investors aiming to navigate market volatility effectively.

Central Bank Policies and Interest Rates

Central banks play a pivotal role in shaping the stock market through their monetary policies. Changes in interest rates can influence borrowing costs, consumer spending, and ultimately corporate profits. When central banks lower interest rates, it often leads to increased investment in stocks as borrowing becomes cheaper.

Conversely, rising interest rates can lead to a decrease in stock prices as companies face higher costs and consumers reduce spending. Investors must stay informed about central bank decisions to anticipate their impact on the stock market.

Global Pandemics and Economic Recovery

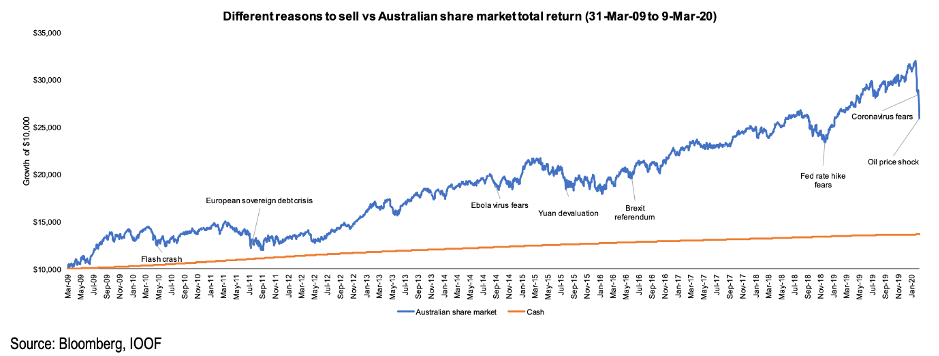

Global events such as pandemics have profound effects on the stock market. The COVID-19 pandemic, for instance, led to unprecedented market declines as businesses shut down and consumer behavior changed dramatically. However, as economies began to recover, stock markets rebounded, highlighting the resilience of certain sectors.

Investors must analyze how different industries respond to such global events, as some may thrive while others struggle. Understanding these dynamics is crucial for making strategic investment decisions in the face of uncertainty.

Technological Advancements and Market Disruption

Technological advancements can disrupt traditional industries and create new market opportunities. Events such as the rise of e-commerce and digital currencies have reshaped investor focus, leading to significant shifts in stock valuations. Companies that adapt to technological changes often see their stock prices soar, while those that fail to innovate may face declines.

Investors should keep an eye on emerging technologies and their potential impact on various sectors, as this can provide valuable insights into future market trends.

Environmental Changes and Sustainable Investing

Environmental events, such as climate change and natural disasters, are increasingly influencing stock market dynamics. Investors are becoming more aware of the importance of sustainability, leading to a rise in socially responsible investing. Companies that prioritize environmental sustainability often attract more investment, while those that neglect these issues may face backlash.

Understanding the relationship between environmental factors and market performance is essential for investors looking to align their portfolios with sustainable practices.

Global Trade Agreements and Economic Impact

Global trade agreements can significantly influence stock markets by affecting tariffs, trade flows, and economic relationships between countries. Positive trade agreements can boost investor confidence and lead to stock market gains, while trade disputes can have the opposite effect.

Investors should monitor trade negotiations and agreements closely, as they can provide insights into potential market movements and sector performance.

Investor Sentiment and Behavioral Economics

Investor sentiment plays a crucial role in shaping stock market trends. Psychological factors, such as fear and greed, can lead to irrational market behavior, causing stock prices to deviate from their intrinsic values. Understanding behavioral economics can help investors recognize patterns in market movements and make more informed decisions.

By analyzing investor sentiment indicators, such as the Fear & Greed Index, investors can gain insights into market psychology and adjust their strategies accordingly.

| Global Event | Description | Impact on Stock Market |

|---|---|---|

| Economic Crises | Financial downturns, such as recessions or depressions, that affect global economies. | Typically lead to decreased consumer spending, lower corporate profits, and falling stock prices. |

| Geopolitical Tensions | Conflicts between nations, including wars, trade disputes, and sanctions. | Can create uncertainty, leading to market volatility and investor flight to safety. |

| Natural Disasters | Events such as earthquakes, hurricanes, and floods that disrupt economies. | Often result in immediate stock declines in affected sectors, particularly insurance and infrastructure. |

| Technological Advancements | Innovations that change industries, such as AI, renewable energy, and biotechnology. | Can lead to stock surges in tech sectors, while traditional industries may suffer. |

| Global Pandemics | Widespread health crises, like COVID-19, that impact daily life and economies. | Typically cause significant market declines initially, followed by recovery phases as economies adapt. |

| Regulatory Changes | New laws or regulations that affect business operations, such as environmental policies. | Can lead to stock price fluctuations based on perceived impacts on profitability. |

| Interest Rate Changes | Decisions by central banks to raise or lower interest rates to control inflation. | Higher rates can lead to lower stock prices as borrowing costs increase; lower rates can stimulate growth. |