The recent proposal for a new tax bill has ignited a fierce debate in the Senate, as lawmakers grapple with its potential impact on taxpayers and the economy. With various stakeholders voicing their concerns, the phrase “New Tax Bill Faces Strong Opposition In Senate” has become a rallying cry for those advocating for a more equitable tax system. As the Senate prepares to deliberate on this contentious issue, understanding the nuances of the bill and the arguments against it is crucial for every citizen.

In the following sections, we will delve into the key components of the new tax bill, highlighting the specific provisions that have drawn criticism from both sides of the aisle. You will learn about the economic implications of the proposed changes, including how they may affect individual taxpayers and businesses alike. Additionally, we will explore the political landscape surrounding the bill, examining the motivations behind the opposition and the potential consequences of its passage or failure.

Stay with us as we unpack the complexities of this significant legislative effort. By the end of this article, you will have a comprehensive understanding of the challenges facing the new tax bill and the broader implications for fiscal policy in the United States. Don’t miss out on this essential information that could impact your financial future—read on to stay informed!

The recent tax bill proposed in the Senate has sparked significant debate and controversy. As lawmakers grapple with its implications, various aspects of the bill have come under scrutiny. This article delves into the key issues surrounding the new tax legislation and the opposition it faces.

Economic Impact of the New Tax Bill

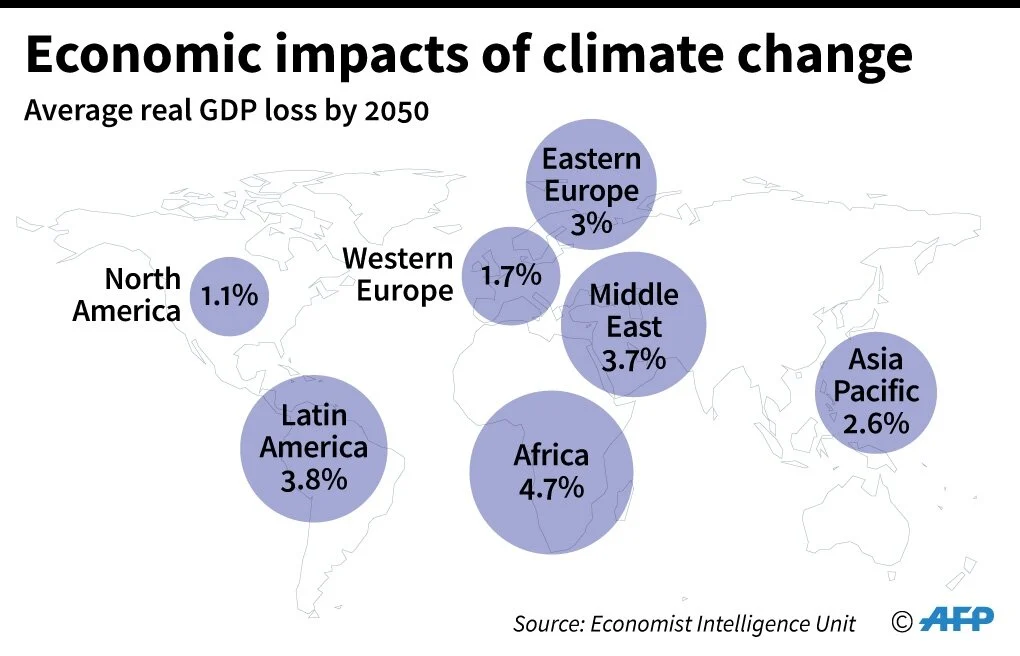

The economic ramifications of the new tax bill are a primary concern for many senators. Proponents argue that the bill will stimulate growth by reducing taxes for businesses, thereby encouraging investment and job creation. However, opponents warn that the bill could disproportionately benefit the wealthy, leading to increased income inequality.

Furthermore, critics highlight that the potential reduction in tax revenue could result in cuts to essential public services. This raises questions about the long-term sustainability of the proposed tax cuts and their effect on the overall economy. The debate continues as senators weigh the immediate benefits against potential future consequences.

Public Opinion and Voter Sentiment

Public opinion plays a crucial role in shaping the legislative process. Recent polls indicate that a significant portion of the electorate is skeptical about the new tax bill. Many voters express concerns that the bill favors corporations and the wealthy at the expense of middle-class families.

This sentiment is particularly important as senators consider their re-election prospects. With midterm elections approaching, lawmakers are acutely aware that their constituents’ views on the tax bill could influence their political futures. As a result, some senators may be more inclined to oppose the bill to align with voter sentiment.

Key Provisions of the New Tax Bill

The new tax bill includes several key provisions that have garnered attention. Among these are proposed changes to corporate tax rates, individual tax brackets, and deductions for various expenses. Understanding these provisions is essential for evaluating the bill’s overall impact.

For instance, the bill suggests lowering the corporate tax rate, which supporters claim will enhance competitiveness. However, critics argue that this could lead to a significant loss in government revenue, affecting funding for social programs. A detailed analysis of these provisions is necessary to grasp the full scope of the bill’s implications.

Political Dynamics in the Senate

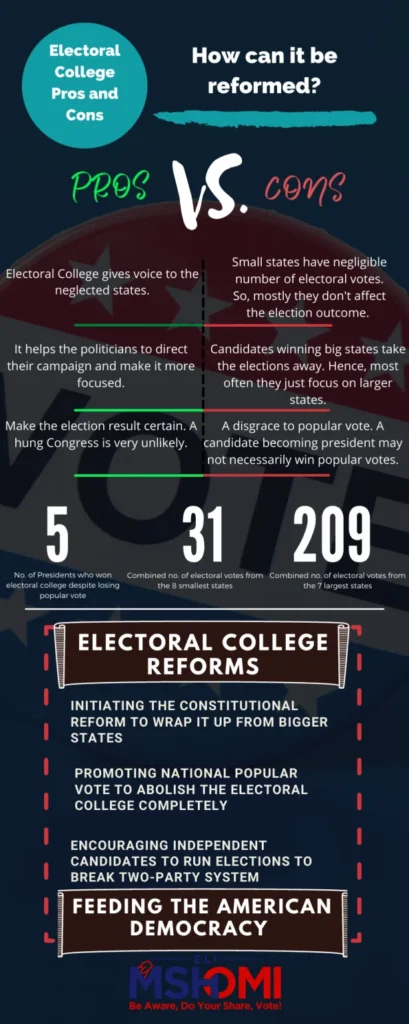

The political landscape in the Senate is a critical factor in the fate of the new tax bill. With a closely divided chamber, every vote counts. The dynamics between party lines, as well as the influence of moderate senators, will play a significant role in determining whether the bill passes.

Additionally, the strategies employed by party leaders to rally support or opposition can significantly impact the legislative process. Understanding these political dynamics is essential for predicting the bill’s trajectory and the potential for amendments or compromises.

Historical Context of Tax Legislation

Examining the historical context of tax legislation in the United States provides valuable insights into the current debate. Previous tax reforms have often faced similar opposition, reflecting the contentious nature of tax policy. Historical examples can shed light on the potential outcomes of the current bill.

For instance, past tax cuts have frequently led to debates about their effectiveness in stimulating economic growth. Analyzing these historical precedents can help lawmakers and the public understand the potential consequences of the new tax bill and the lessons learned from previous reforms.

Future Implications and Next Steps

The future implications of the new tax bill extend beyond immediate economic effects. If passed, the bill could set a precedent for future tax policy and influence the direction of fiscal policy in the coming years. Senators must consider not only the current landscape but also the long-term effects of their decisions.

As the Senate continues to debate the bill, stakeholders from various sectors are closely monitoring developments. The next steps will involve negotiations, potential amendments, and further discussions to address concerns raised by both supporters and opponents of the bill. The outcome remains uncertain, but its implications will undoubtedly shape the future of tax policy in the United States.

| Aspect | Description |

|---|---|

| Title | New Tax Bill |

| Purpose | The bill aims to reform the current tax system, aiming for increased revenue and simplified tax codes. |

| Key Provisions |

|

| Opposition |

|

| Current Status | The bill is currently facing strong opposition in the Senate, with debates ongoing regarding its implications. |

| Next Steps | Further discussions and potential amendments are expected before a vote is scheduled. |